Understand the market and opportunity

Diversifying your payment mix to include payment methods in high demand, like Benefit Acceptance, increases customer retention and repeat business.

Total online spend via benefits transactions1

Monthly benefit participants2

Annual government funding2

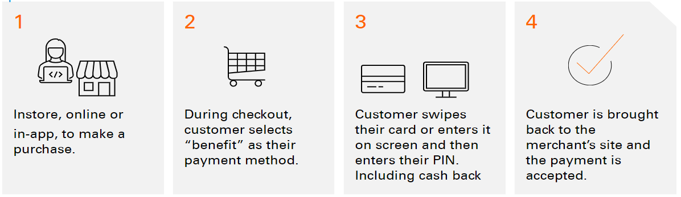

Extend omnichannel checkouts to all your customers

Allow customers needing benefit assistance to pay wherever, whenever, and however they want across physical and digital channels.

Program for the healthcare and nutrition of low-income, pregnant, or breastfeeding women as well as infants and children under the age of five.

Offers additional state-funded rewards for buying healthy foods.

Cash benefits for general purchases (that is, shelter, food, personal hygiene, transportation, clothing, home maintenance, fuel).

The value of Benefit Acceptance

For merchants:

- Single source: One relationship for all benefit types

- Revenue: Increase cash flow

- Reach: Engage customers in all 50 states and territories

- Loyalty: Grow customer base and boost retention

- Good will: Help low-income families needing assistance

- Card modernization: Enable benefit chip acceptance

For consumers:

- More options: In-store, contactless, online, in-app transactions; use alternate payments

- Convenience: Buy online and skip the checkout lines

Seamless shopping journeys

Facilitate effortless in-store, contactless, online and in-app payment experiences.

Ideas and inspiration

Tell us your vision and we'll bring the solution

We will work with you to understand your business needs and show you how to best leverage our solutions to make your vision a reality.

Source: (1) internal and client related results, (2) Pew Research Center