Cryptocurrency has been garnering headlines for the past decade, and many businesses globally are trying to understand how and when they can enable their customers to use cryptocurrency to pay for goods and services. Is it just a passing technology fad? Statistics say no. According to our 2021 Carat Insights study, a survey of 2,200 U.S. adults conducted to understand key issues about cryptocurrency, 16% of consumers reported having used crypto at least once to pay for goods and services.

While the financial community continues to assess the future of cryptocurrency, it’s clear from our research that cryptocurrency is building momentum as a viable payment option for consumers. Businesses are increasingly looking to accept cryptocurrency payments via their existing payments acceptance technology. Not only are investors pouring money into the space, and businesses devising solutions to embrace digital currencies, regulators are moving to provide guidelines to foster adoption as evidenced by President Biden’s executive order on March 9, recent white papers published by the Federal Reserve, and numerous legislative proposals introduced over the last year.

The ongoing evolution of government regulation will be critical in determining future use cases for crypto payments.

Cryptocurrency at a tipping point

Businesses across multiple industries, including grocery stores, gas stations, retailers, and convenience stores, are exploring options for expanding their digital commerce technology to include cryptocurrency acceptance. Why? Consumers are continually asking their favorite retail brands about accepting cryptocurrency as a form of digital payment. The demand is there, and Carat can help address a businesses’ desire to expedite crypto acceptance.

To effectively employ digital currency solutions, a business needs to understand the benefits of accepting cryptocurrency as a payment type through a trusted partner like Carat. There are many positives to using Carat’s commerce orchestration and optimization technology to enable cryptocurrency as a digital payment option, including:

- Faster delivery of funds

- Simplified cross border transfers

- Reduced risk by avoiding cryptocurrency volatility

- Single-source integration for settlement and reporting

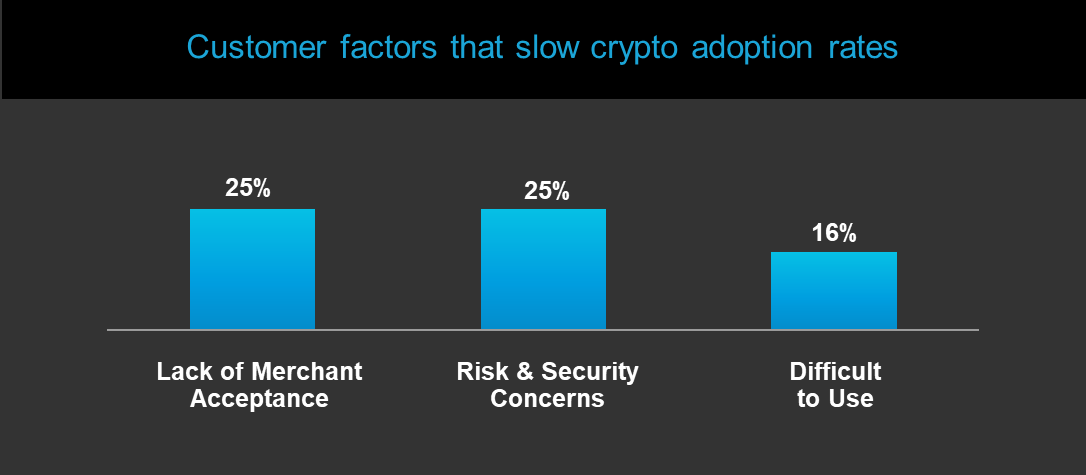

Carat Insights indicates that 25% of cryptocurrency users cite a lack of merchant acceptance as limiting increased usage. Furthermore, the research shows that 25% of respondents are concerned about security and 16% find it difficult to use.

The good news is that payment security is actually strong when using cryptocurrency, mitigating some consumers’ fears, and as more points of payment are enabled for digital currencies, paying with a crypto asset is rapidly becoming more practical and appealing. Some businesses even see the acceptance of crypto as more secure than accepting traditional credit or debit card transactions because crypto payments do not need third-party verification, and card payment information is not stored by the business. Furthermore, while payment disputes are certainly possible, at present, there are no chargebacks associated with payment using cryptocurrency.

How to accept cryptocurrency payments

Merchants looking to incorporate cryptocurrency into their digital payment options should consider pursuing a graduated deployment strategy. The first step is to accept cryptocurrency payments into digital channels prior to incorporating it into a full point-of-sale (POS) platform. New forms of ecommerce solutions are available that allow merchants to simply add cryptocurrency as a form of payment. Settlement will continue to occur for the merchant in fiat, which removes the complexity and risk associated with the merchant holding crypto at any point, or needing to establish a crypto wallet.

It’s reassuring to businesses that enabling payment via cryptocurrency doesn’t require investing in new software or hardware. Incorporating cryptocurrency into your existing payment stack via Carat will be done quickly and easily without creating headaches for your engineering teams.

There are no major hurdles preventing merchants enabling cryptocurrency as a payment type, and doing so in a manner that is familiar to consumers. For instance, an ecommerce merchant working with Carat can simply add a crypto wallet payment option to their consumer checkout experience. In-store, merchants can present consumers with a QR-code at the point-of-sale than can be scanned with a mobile device to prompt payment from a digital wallet. This QR-code experience is identical to the manner in which consumers pay at the point of sale with PayPal and Venmo wallets today. In both of these examples, Cryptocurrency can be viewed as another digital payment option that offers customers increased flexibility.

Fiserv has the experience and knowledge to be your trusted partner

Fiserv works with a variety of companies to facilitate incorporating cryptocurrency into the digital payment process, including:

- Bakkt: enabling practical uses of crypto and emerging asset classes.

- New York Digital Investment Group: integrating an enterprise services framework that streamlines customer and employee experiences.

- First Foundation Bank: helping consumers manage bitcoin transactions directly within their financial institutions' online and mobile banking portals.

Fiserv is at the forefront of enabling digital payment acceptance; adding cryptocurrency or any other form of digital payment into the mix is what we do best. To learn more about how to accept cryptocurrency payments with Fiserv, contact Carat today.