Cryptocurrency is no longer just an asset class, but a popular digital payment method. Customer adoption of crypto payments is growing rapidly and expected to continue. In the latest Carat Insights findings, we conducted a consumer survey of 2,200 U.S. adults to understand customer adoption, demographics, and reasons for using crypto as a payment method.

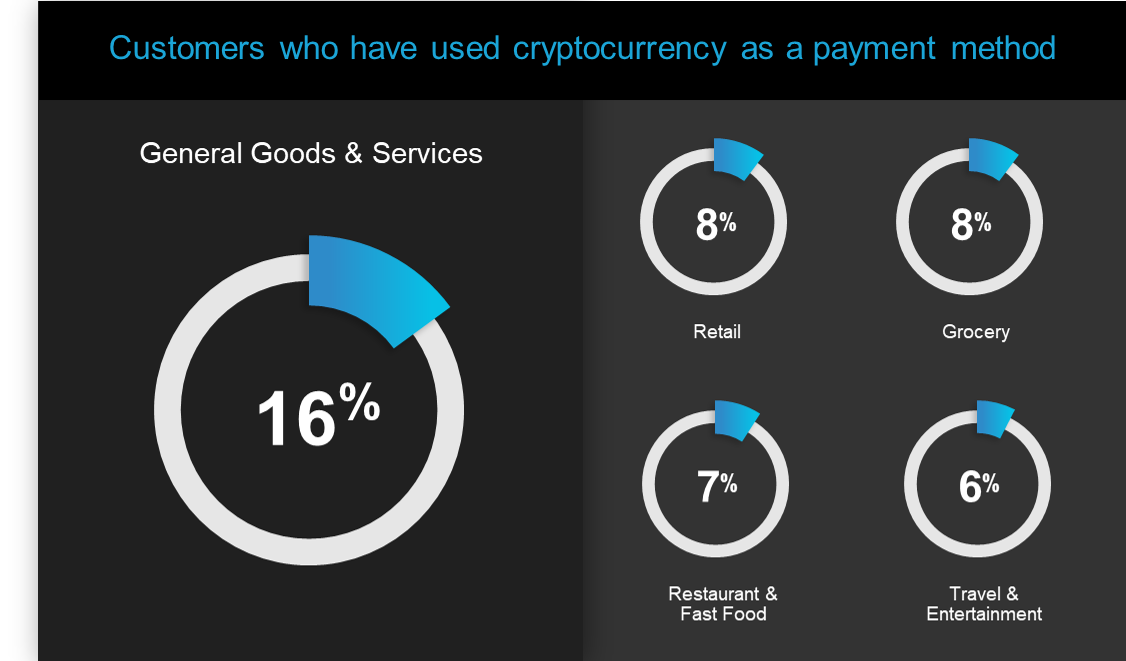

- 16% of Americans report having used crypto at least once to pay for goods and services. Crypto users pay with crypto consistently across verticals

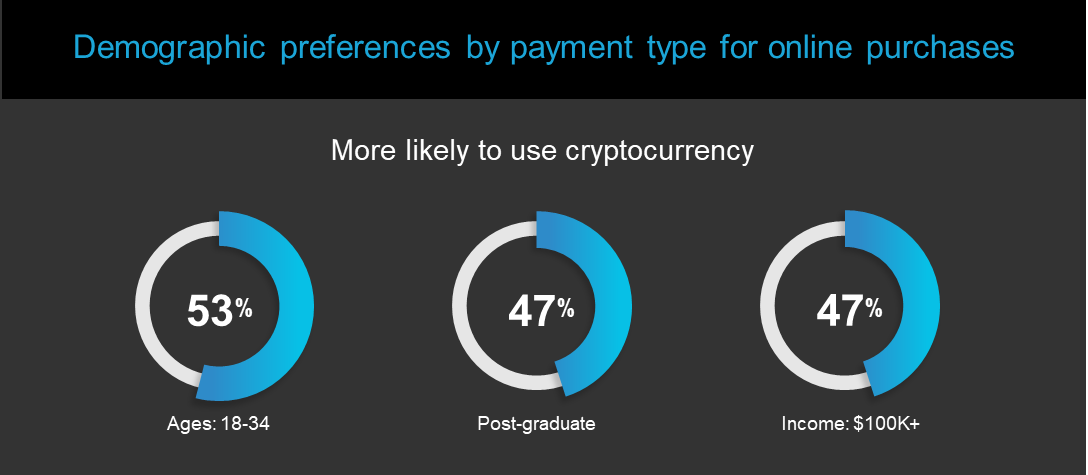

- 53% of customers who have paid with crypto are aged 18-34. Customers with higher education and higher income are also driving the use of crypto.

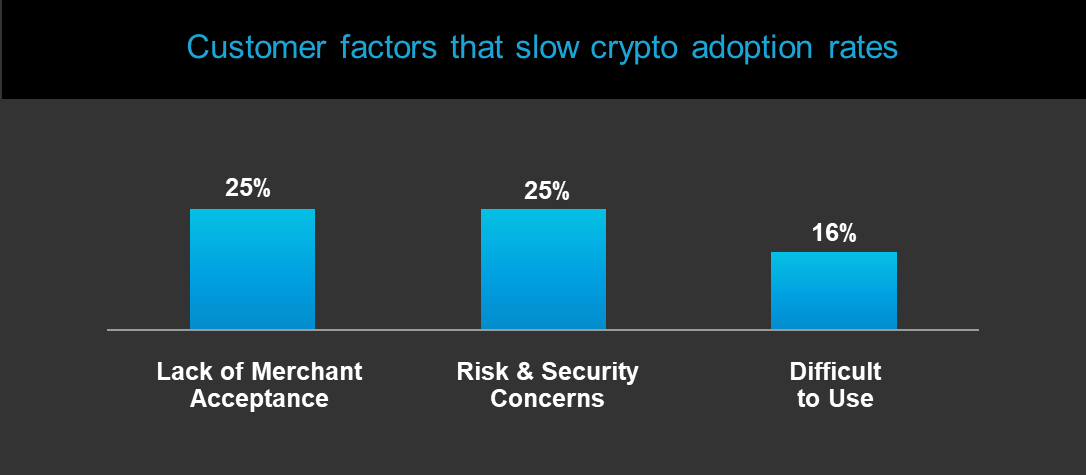

- 25% of crypto users cite lack of merchant acceptance as a limitation to increased usage. Additional reasons that prevent higher adoption rates include security & risk concerns and difficulty of use.

How many consumers use crypto as a payment method?

Customers have multiple options to pay using crypto, including paying a merchant directly (example: Overstock.com), sending a peer-to-peer transaction via a digital wallet (example: PayPal), using a specialty card (example: Visa branded Coinbase card), purchasing a merchant gift card, or using a Bitcoin ATM to convert crypto into fiat currency.

Our survey shows that 16% of Americans have made at least one purchase using crypto as a payment method across a variety of verticals, including Retail, Grocery, Restaurant & Fast Food, and Travel & Entertainment.

However, very few merchants accept crypto, which is reflected in the significant gap between customer interest and customer behavior. Customer interest levels are high, at an average of 34% across verticals. Crypto users would like to consistently use crypto for a variety of purchases - from everyday items (Grocery, Restaurant & Fast Food) to higher ticket discretionary items (Retail, Travel & Entertainment).

Interestingly, more than half of respondents note that they are mainly interested in using crypto online, and a third of respondents indicate that they are interested in using crypto equally in-store and online.

Which customer demographics are driving crypto adoption?

While it is growing in popularity among the general population, crypto adoption is largely driven by specific demographics. Specifically, customers who are younger, highly educated, and with higher incomes. Our data suggests that these types of customers are early adopters of new technologies and innovative payment methods, such as Digital Wallets and Buy Now Pay Later (BNPL). They are looking for flexibility in payments.

What prevents customers from using crypto as a payment type?

As customer interest in crypto payments continues to grow, many customers still cite a few common issues that are limiting widespread adoption and frequent use.

A quarter of crypto users point to lack of merchant acceptance. Our data shows an 18% gap between customer interest and behavior. There is a unique opportunity for merchants to capture more crypto spend by enabling crypto acceptance.

Security and risk concerns are cited by a quarter of crypto users. Customers are worried about price volatility. They also share concerns that their crypto assets could be vulnerable to malware, hacking, and theft. Merchants can alleviate concerns by providing a clear and secure payment process.

With all the different ways to pay with crypto, the customer experience is often inconsistent, requiring significantly more time and effort to pay compared to established payment methods. While some customers will go greater lengths to pay with crypto, merchants can improve adoption rates by reducing the amount of steps it takes and making it as seamless to pay with crypto as it is with card, cash, and digital wallets.

So, should you enable crypto acceptance?

There is a significant gap between the number of customers who have paid with crypto (16%) and those who are interested in paying with crypto (34%), which suggests there is untapped potential for crypto payments. When considering whether to accept crypto payments there are a few questions you can ask to help you make a decision:

- Do your customers fit the demographics driving crypto adoption? If yes, accept crypto.

- Can you confidently and clearly reassure your customers their purchases are more secure both online and in-store? If yes, accept crypto.

- Have you built a strong outreach plan with social media and checkout messaging to let customers know you are now accepting crypto? If yes, accept crypto.

Carat will soon be launching a crypto acceptance solution, which will offer the following benefits for merchants:

- Lower cost of acceptance compared to credit card

- Lower risk by avoiding crypto volatility

- Convenient single-source integration for settlement and reporting

Learn more about our partner Bakkt or contact a Carat crypto expert today.

Source: Carat Insights Report and Fiserv data