The world's leading payments platform... ready to go.

We give you more choice

Our single platform is built in a modular way, allowing you to build your unique payments business.

You keep more control

The simplicity of out-of-the-box, with the ownership of something you built yourself. Get up and running in days, not months.

Trust us to deliver

The world's #1 global issuer processor and #1 global merchant acquirer.

Let us manage the complexity as you go for growth

Payment Facilitators: Fueling new business growth

Allow your sellers to sell seamlessly as you manage the full sub-merchant lifecycle. Keep regulators, schemes, and sponsors happy so you can focus on winning and retaining customers.

ISVs: Embedding payments in your software

Accept payments fast, eliminate manual processes, and reduce compliance risk so you can focus on building great software.

Banks: Supercharging the merchant experience

Enable frictionless merchant boarding with intuitive risk management that allows your clients to get to market faster and cheaper.

Boarding made easy

Never let a bad customer experience cost you a deal. Fast, efficient boarding solutions that orchestrate third-party and internal systems to help you turn prospects to customers – face-to-face, on the phone, or online.

- Supports multiple sales channels

- Proven application conversion improvement

- Reduced cost per application

- Third-party integrations to accelerate delivery

1

Sign Agreement

2

Platform Boarding

3

Sub-merchant Boarding

1

Sign Agreement

2

Platform Boarding

3

Sub-merchant Boarding

Manage credit and risk

Scale safely in the knowledge that credit risk is under control. Our next-generation credit and risk technology is built to support merchant onboarding and dynamic, in-life management, offering continuous automated customer credit and fraud risk assessment on both hard and soft measures.

- Onboarding and in-life assessments, combined

- Flexible rules engine and intuitive configuration

- Easy integration via a REST web services API

- Cost-effective implementation and maintenance

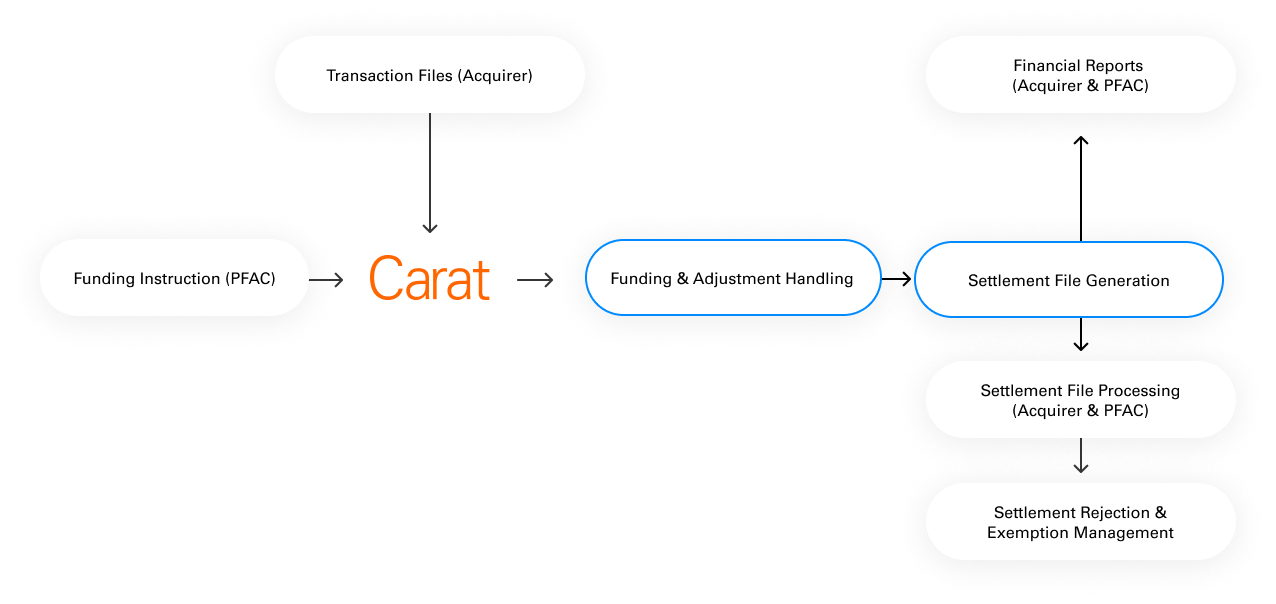

Intelligent money movement

Serve merchants safely in the knowledge that money will move where it’s meant to. Our money settlement functionality imports and rates transaction data, calculates settlement batches for onward distribution to merchants and funds transactions. It can either be used for instructional funding or as managed settlement services.

- Comprehensive invoicing, crediting and statementing functionality

- Runs alongside the processing and settlement of transactions

- Built-in deposit and reserve management

- Full reconciliation and reporting via a funding dashboard

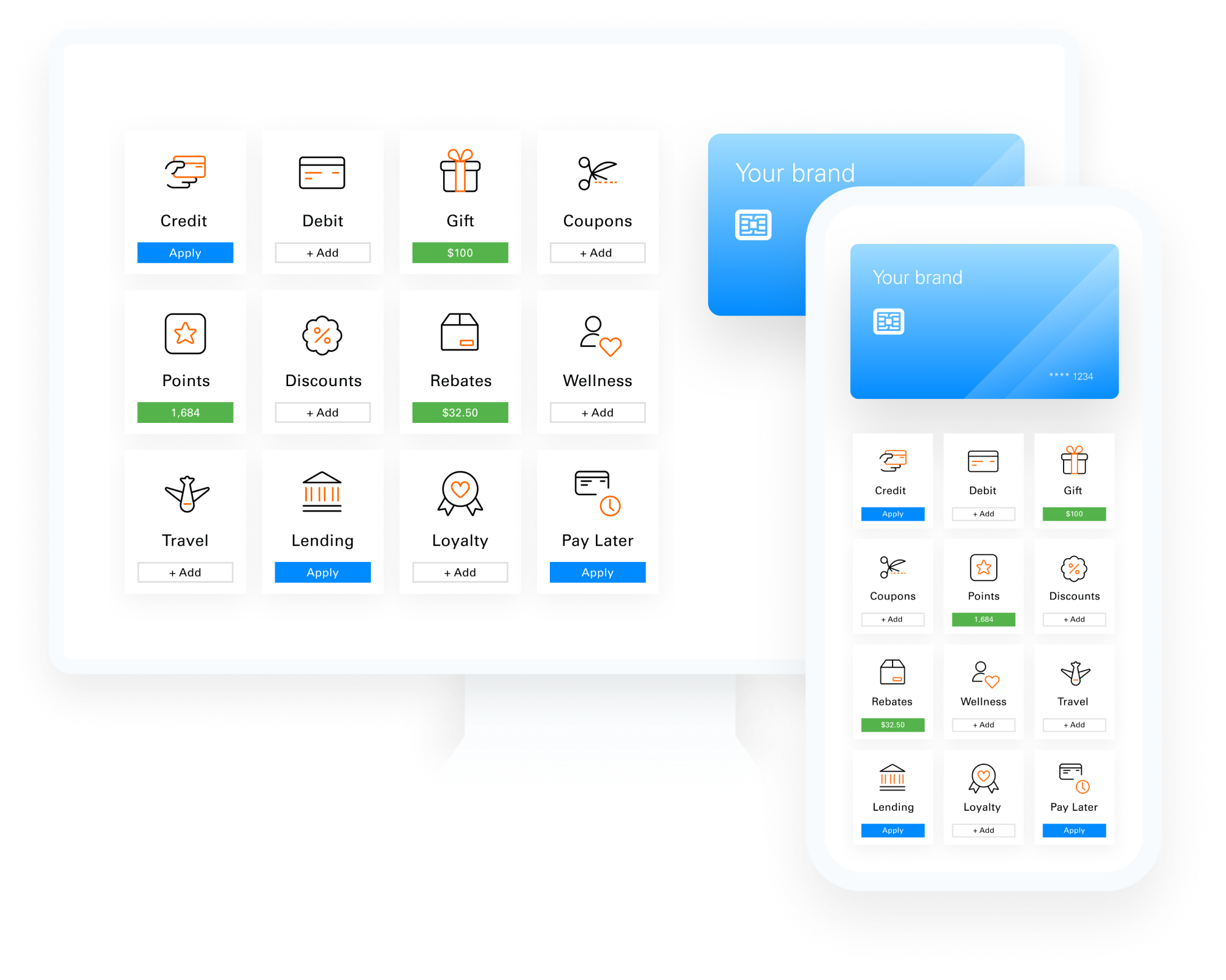

Unlock platform growth with embedded finance

Create new revenue streams and enrich customer experiences by embedding a financial journey that integrates

banking and payment solutions effortlessly.

Ideas and inspiration

Tell us your vision and we'll bring the solution

We will work with you to understand your business needs and show you how to best leverage our solutions to make your vision a reality.